This summer, NAIFA kicked off a new Member-to-Member Program, the P&C Study Group. This group has consistently met monthly to discuss topics ranging from incorporating more life insurance sales to leveraging AI in your practice. The P&C Study group is open to all NAIFA members, regardless of practice specialty. Help us plan for 2025 by taking our brief survey to identify future topics, volunteer to moderate, and determine the date and time for the monthly call.

Looking to sell more life insurance in your practice? Here's an article summarizing a recent P&C Study Group Call.

Strategies for Selling Life Insurance in P&C Practices: Key Ideas from Industry Professionals

At a recent P&C Study Group session, industry experts discussed effective ways to incorporate life insurance into property and casualty practices. The conversation included ideas on bundling policies, using insurance calculators, and addressing budget concerns. Here are the key insights shared:

- Make Life Insurance a Core Part of Client Conversations

- James Belford shared how directly asking clients about life insurance is part of his standard approach: “Tell me about your life insurance program” often reveals gaps and opens dialogue. By regularly initiating these conversations, agents like James make life insurance a more natural part of client discussions.

- Joshua Herrington-Vickers added that he often leads with questions about family goals and long-term security to transition naturally into life insurance discussions. “It’s about helping them see the bigger picture,” he explained. “Once they understand it’s for their family’s future, it’s easier to start talking about options.”

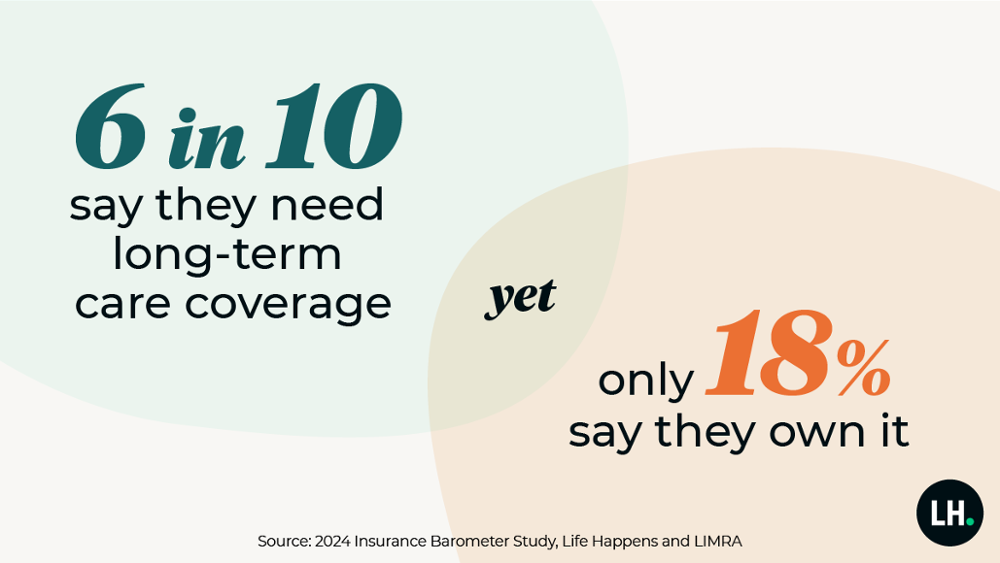

- Utilize Life Happens’ Insurance Calculator to Illustrate Affordability

- An insurance calculator can help clients understand policy costs, making life insurance more accessible. With this tool, agents can quickly show various coverage options based on the client’s age, health, and desired amount of coverage. Jennifer Hodges is going to start including a link to the calculator in her email signature.

- Edward Bartling highlighted that using calculators helps address the common objection that life insurance is too expensive. “When clients see that they can start small and build up over time, it removes a lot of hesitation,” Edward noted. He often uses the calculator to illustrate different policy levels, helping clients find coverage that aligns with their budgets.

- Position Life Insurance as Essential for Financial Security

- Jennifer emphasized presenting life insurance as foundational to financial security, framing it as essential rather than optional. “Sometimes clients just need that nudge to see it as part of a holistic plan,” Jennifer explained.

- Edward builds on this approach by asking clients to think about future goals and potential risks. “I tell them it’s about giving themselves options for the future,” he said. By connecting life insurance to peace of mind, Edward finds clients more receptive to adding it to their P&C packages.

- Offer Bundled Policies and Financial Incentives

- Bundling policies with discounts for auto, home, and life insurance can make life insurance more attractive and affordable. James and others noted that bundling also strengthens client loyalty since clients prefer to manage their insurance needs in one place.

- Joshua mentioned that bundling policies has improved client retention in his practice. “When clients see the financial benefit and ease of managing everything with one agent, they’re more likely to stay loyal,” he explained.

- Focus on One-on-One Relationship Building

- While automated marketing can help reach clients, several participants noted that personal conversations are far more effective for life insurance. One-on-one relationship building allows clients to feel more comfortable discussing their needs, which is essential for selling life insurance.

- Edward shared that he relies on personalized follow-ups and check-ins rather than relying on mass emails. “It’s the individual conversations that make the difference,” he said. This approach allows agents like Edward to address unique client needs and build trust.

- Regularly Follow Up and Reintroduce Life Insurance Options

- When clients say they already have a life insurance provider, agents can ask, “How’s that working for you?” to uncover any unmet needs. Revisiting the topic periodically ensures that clients have multiple chances to reconsider their life insurance options.

- Joshua echoed the importance of follow-up, sharing that clients’ circumstances often change over time. “They might not be ready now, but in a year, their priorities might shift,” he said. Regular check-ins allow agents to reintroduce life insurance as clients’ lives evolve.

- Provide Flexible Policy Options to Address Budget Constraints

- Offering a range of coverage levels and showing affordability with an insurance calculator allows agents to accommodate clients with different financial situations. This flexibility can help overcome budget-based objections to life insurance.

- Both Edward and Joshua noted that clients are more likely to commit when they know they can start with a smaller policy and adjust over time. This approach reassures clients that life insurance can be both affordable and adaptable to their evolving needs.

The session concluded with consensus: integrating life insurance into P&C practices fosters stronger client relationships and enhances their financial security.

.png)